.png?width=992&height=248&name=Copy%20of%20SM%20Teaser%20Twitter%20Sized%20(2).png)

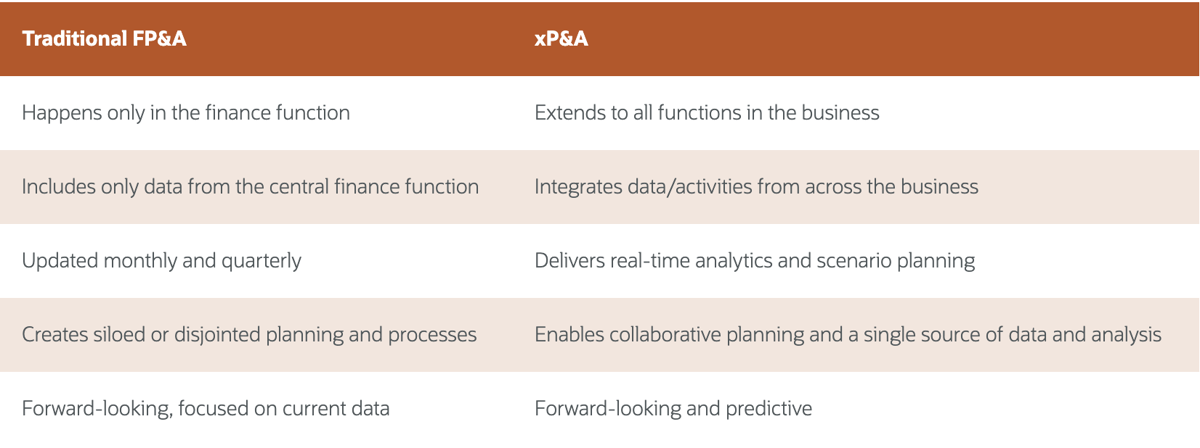

Having a financial plan in place is a must for any successful business, but have you thought about going beyond typical financial planning & analysis? Enter extended planning & analysis. Extended planning & analysis (xP&A) goes beyond the usual structured approach to budgeting, planning, forecasting and reporting to allow the finance team to deliver data to senior executives...

Extended planning and analysis may be the logical evolution of FP&A, but expanding the use of these processes, data and tools beyond the finance function takes careful forethought and planning.

Ready to introduce xP&A to your organization? Here are the steps you need to take...

Get buy-in. Evolving from FP&A to xP&A requires support from the executive team and departmental leadership.

Develop an xP&A strategy. Finance must create a plan for how it will lead the extension of FP&A across the business.

Rethink data and architecture. A “lift and shift” of existing systems may not be enough to realize the full benefits of xP&A. Determine what digital tools and capabilities will enable the organization’s xP&A goals.

Decide on key data and metrics. Finance can work with other departments and business units to understand what data is most important to both their operational performance and financial results, what changes might be made and, ultimately, which metrics to incorporate into xP&A.

Invest in change management. Implementing xP&A demands changes from everyone involved — from executives and board members to managers and users — not to mention the IT department. Don’t skimp on change management and communication throughout the xP&A deployment process.

Plan for continuous improvement. xP&A processes can be expanded and improved over time. Adopting a test-and-learn approach can enable greater success as organizations scale their use of xP&A to different functions, business units or geographic locations.

The Vested Group

1001 18th Street

Plano, TX 75074

USA

872-326-9361

Send Us an Email

Copyright © 2024. All rights reserved. Privacy Policy. Cigna MRFs.